Business & Tax Incentives

Business & Tax Incentive Options

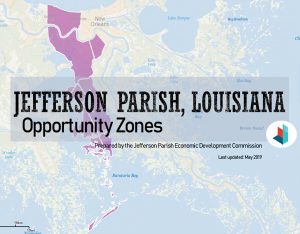

Opportunity Zone

The Opportunity Zone program is a new community and economic development tool established by Congress that allows investments in certain economically distressed communities to be eligible for preferential tax treatment.

- Tax Cuts and Jobs Act of 2017 created a new community development program that encourages private investment in qualified opportunity zones.

- The program allows taxpayers to defer and reduce gain from the sale or exchange of property if the taxpayer reinvests the gain proceeds in a qualified opportunity fund.

- Louisiana secured U.S. Department of the Treasury certification for 150 lower-income census tracts to be Opportunity Zones.

- The primary attraction for investing in Opportunity Zones is deferring and lowering federal taxes on capital gains.

For a qualified Opportunity Zones investment:

- Capital gains taxes may be deferred the first five years;

- After Year 5, taxes may be cancelled on 10 percent of the original capital gains investment and deferred for the remainder;

- In Year 7 through Year 10, taxes may be cancelled on 15 percent of the original capital gains investment;

- The remainder may be deferred through 2026.

- For Opportunity Zones investments lasting longer than 10 years, investors are exempt from capital gains taxes on the Opportunity Zones investment itself, in addition to the other benefits for capital gains carried into the investment.

To view an interactive map of all eligible Opportunity Zone areas in Louisiana, <<Click Here>>